UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.DC 20549

SCHEDULE 14A

(RULE 14A-101)14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No.)

Filed by the Registrantregistrantx

Filed by a Partyparty other than the Registrantregistrant¨

Check the appropriate box:

¨ Preliminary

x Definitive

¨ Definitive

¨ Soliciting Material | ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

Kewaunee Scientific Corporation

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other thanOther Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

KEWAUNEE SCIENTIFIC CORPORATION

2700 West Front Street

Statesville, North Carolina 28677-2927

William A. Shumaker

President and

Chief Executive Officer

July 16, 2004

20, 2007

TO OUR STOCKHOLDERS:

You are cordially invited to attend the Annual Meeting of Stockholders of Kewaunee Scientific Corporation (the “Company”), which will be held on the 37th floor at Harris Trust & Savings Bank, 111 West Monroe Street,The Conference Center at UBS Tower, One North Wacker Drive, 2nd Floor, Chicago, Illinois, on August 25, 2004,22, 2007, at 10:00 A.M. Central Daylight Time.

At the meeting, management will review with you the Company’s past year’s performance and the major developments which occurred during the year. There will be an opportunity for stockholders to ask questions about the Company and its operations. We hope you will be able to join us.

To assure that your shares are represented at the meeting, please vote, sign and return the enclosed proxy card as soon as possible. The proxy is revocable and will not affect your right to vote in person if you are able to attend the meeting.

The Company’s 20042007 Annual Report to Stockholders is enclosed.

Sincerely yours, |

/s/ William A. Shumaker |

KEWAUNEE SCIENTIFIC CORPORATION

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

to be held on

August 25, 200422, 2007

The Annual Meeting of Stockholders of Kewaunee Scientific Corporation will be held on the 37th floor at Harris Trust & Savings Bank, 111 West Monroe Street,The Conference Center at UBS Tower, One North Wacker Drive, 2nd Floor, Chicago, Illinois, on August 25, 2004,22, 2007, at 10:00 A.M. Central Daylight Time, for the purpose of considering and acting upon the following:

| (1) | To elect two Class III directors; and |

| (2) | To transact such other business as may properly come before the meeting. |

Stockholders of record at the close of business on July 6, 20045, 2007 will be entitled to vote at the meeting. A list of stockholders will be available for examination by any stockholder for any purpose germane to the meeting, during normal business hours, at the offices of Bell, Boyd & Lloyd LLC,LLP, 70 West Madison Street, Chicago, Illinois, for a period of 10 days prior to the meeting.

It is important that your shares be represented at the meeting regardless of the size of your holdings. Whether or not you intend to be present at the meeting in person, we urge you to vote, date and sign the enclosed proxy and return it in the envelope provided for that purpose, which does not require postage if mailed in the United States.

D. MICHAEL PARKER

Secretary |

July 16, 200420, 2007

YOUR VOTE IS IMPORTANT

Please vote, date and sign the enclosed proxy and return it

promptly in the enclosed envelope.

KEWAUNEE SCIENTIFIC CORPORATION

PROXY STATEMENT

The enclosed proxy is solicited by the Board of Directors of Kewaunee Scientific Corporation (the “Company”) for use at the annual meeting of stockholders of the Company to be held on the 37th floor of Harris Trust & Savings Bank, 111 West Monroe Street,at The Meeting Center at UBS Tower, One North Wacker Drive, Second Floor, Chicago, Illinois, on August 25, 2004,22, 2007, at 10:00 A.M. Central Daylight Time, and at any postponements or adjournments thereof. Proxies properly executed and returned in a timely manner will be voted at the meeting in accordance with the directions noted thereon. If no direction is indicated, proxies will be voted for the election of the nominees named herein as directors, and on other matters presented for a vote in accordance with the judgment of the persons acting under the proxies.

The Company’s principal executive offices are located at 2700 West Front Street, Statesville, North Carolina 28677-2927 (telephone 704/873-7202).

The proxy, together with this Proxy Statement and the accompanying Notice of Annual Meeting of Stockholders, is being mailed to stockholders on, or about, July 16, 2004.

25, 2007.

ELECTION OF DIRECTORS

Two Class III directors are to be elected at the meeting. The Board of Directors, at its meeting on June 23, 2004,27, 2007, upon the recommendation of the Nominating Committee, selected Margaret Barr BruemmerB. Pyle and Eli Manchester, Jr. as nominees for re-election to serve as directors at the annual meeting, eachboth to serve for three-year terms. Each of theBoth nominees are serving as directors as of the date of this Proxy Statement. The two nominees receiving the greatest number of votes at the annual meeting will be elected directors. Unless a stockholder indicates otherwise on the proxy, proxies will be voted for the election of the two nominees named below. If due to circumstances not now foreseen, either of the nominees becomes unavailable for election, the proxies will be voted for such other person or persons as the Board of Directors may select, or the Board will make an appropriate reduction in the number of directors to be elected.

Information on the two nominees for Class III directors and the current Class I and II directors is shown below.

Class III directors will serve until the annual meeting of stockholders in 2007.2010. The following directors are currently serving as Class III directors and have been nominated for re-election:

MARGARET BARR BRUEMMER, 52,B. PYLE, 55, was elected a director of the Company in February 1995. Ms. BruemmerPyle has been engaged in the practice of law in Milwaukee and Madison, Wisconsin as a sole practitioner for more than five years and has been Trustee of the Allis-Chalmers Corporation Product Liability Trust since June 1996.

ELI MANCHESTER, JR., 73,76, was elected a director of the Company in November 1990. He was elected President and Chief Executive Officer of the Company in July 1990. In August 1999 he was elected Chairman of the Board, retaining the position of Chief Executive Officer. In September 2000, he relinquished the position of Chief Executive Officer, retaining the position of Chairman.

1

Class III directors will continue to serve until the annual meeting of stockholders in 2005. The following directors are currently serving as Class I directors:

WILEY N. CALDWELL, 77, was elected a director of the Company in 1988. From 1984 to 1992, when he retired, he was President of W.W. Grainger, Inc., a distributor of electrical and mechanical equipment.

SILAS KEEHN, 74, was elected a director of the Company in May 2001. From 1981 to 1994, when he retired, he was President of the Federal Reserve Bank of Chicago. He is also a director of the National Futures Association.

Class II directors will continue to serve until the annual meeting of stockholders in 2006.2009. The following directors are currently serving as Class II directors:

JOHN C. CAMPBELL, JR., 61,64, was elected a director of the Company in 1973. Since May 1995, Mr. Campbell has been engaged in private consulting. From May 1992 to May 1995, he was Chief Operating Officer, Executive Vice President and a director of Grounds For Play, Inc. of Arlington, Texas, a manufacturer of specialty equipment for children’s playgrounds.

JAMES T. RHIND, 82,85, was elected a director of the Company in 1966. Since January 1, 1993, he has been engaged in the practice of law as of counsel to the law firm of Bell, Boyd & Lloyd LLC,LLP, Chicago, Illinois, counsel to the Company. Prior thereto, he was a partner in that firm.

WILLIAM A. SHUMAKER, 56,59, has served as President of the Company since August 1999 and Chief Executive Officer since September 2000. He was elected a director of the Company in February 2000. He served as the Company’s Chief Operating Officer from August 1998, when he was also elected Executive Vice President, until September 2000. He served as General Manager of the Company’s Laboratory Products Group from February 1998 until August 1998. He joined the Company in December 1993 as Vice President of Sales and Marketing.

Class I directors will serve until the annual meeting of stockholders in 2008. The following directors are currently serving as Class I directors:

WILEY N. CALDWELL, 80, was elected a director of the Company in 1988. From 1984 to 1992, when he retired, he was President of W.W. Grainger, Inc., a distributor of electrical and mechanical equipment.

SILAS KEEHN, 77, was elected a director of the Company in May 2001. From 1981 to 1994, when he retired, he was President of the Federal Reserve Bank of Chicago. He is also a director of the National Futures Association.

Except as otherwise indicated, each director and nominee has had the principal occupation mentioned above for more than five years. Mr. Campbell is the first cousin of Laura Campbell Rhind, wife of Mr. Rhind.

The Board of Directors, under the Company’s bylaws, has set the size of the Board of Directors at seven members, divided into three classes. The Company’s certificate of incorporation provides that the three classes shall be as nearly equal in number as possible.

The Board of Directors recommends a voteFOR the election of eachboth

of the foregoing nominees for director.

2

Meetings and Committees of the Board

The business and affairs of the Company are managed under the direction of the Board of Directors. Members of the Board keep informed of the Company’s business and activities by reports and proposals sent to them periodically and in advance of each Board meeting and reports made to them during these meetings by the President and other Company officers. The Board is regularly advised of actions taken by the Executive Committee and other committees of the Board, as well as significant actions taken by management. Members of management are available at Board meetings and other times to answer questions and discuss issues. During the Company’s fiscal year ended April 30, 2004,2007, the Board of Directors held nineten meetings.

Currently, the standing committees of the Board of Directors of the Company are the Executive Committee, Audit Committee, Compensation Committee, Financial/Planning Committee, and Nominating Committee. The functions and membership of the committees are described below.

The Executive Committee, consisting of Messrs. Rhind (Chairman), Campbell, Manchester and Shumaker and Ms. Bruemmer,Pyle, exercises the authority of the Board between meetings of the full Board, subject to the limitations of the Delaware General Corporation Law. The Executive Committee met two times during the Company’s last fiscal year.

The Audit Committee, consisting of Messrs. Keehn (Chairman), Campbell and Rhind, each an independent director, performs the responsibilities and duties described in the Company’s Audit Committee Charter, includedwhich is attached as Appendix A to this Proxy Statement, and is responsible for annually appointing the independent auditor for the Company, approving services to be performed by the independent auditor, reviewing the independent auditor’s reports, and reviewing the Company’s quarterly and annual financial statements before release to the public. In accordance with Audit Committee Charter guidelines, the Audit Committee is responsible for reviewing and approving all related party transactions. The Audit Committee met sevenfour times during the Company’s last fiscal year. In addition, theThe Board of Directors has determined that Mr. Keehn, the current Chairman of the Audit Committee, is a “financial expert” within the meaning of the current rules of the Securities and Exchange Commission.

The Compensation Committee, consisting of Messrs. Caldwell (Chairman), Keehn and Rhind and Ms. Bruemmer,Pyle, each an independent director, considers and provides recommendations to the Board of Directors with respect to the compensation (salaries and bonuses) of executive officers of the Company; short- and long-range compensation programs for officers and other key employees of the Company; benefit programs for all employees of the Company; and stock option grants to key employees. The Compensation Committee also acts as the Stock Option Committee, administering and interpreting the stock option plans for officers and other key employees. The Compensation Committee does not have a written charter. The Compensation Committee met threetwo times during the Company’s last fiscal year.

The Financial/Planning Committee, consisting of Messrs. Manchester (Chairman), Caldwell, Keehn and Shumaker and Ms. Bruemmer,Pyle, reviews and provides recommendations to the Board of Directors with respect to the annual budget for the Company, the Company’s strategic plan and the annual budget for capital expenditures. The Financial/Planning Committee also reviews the investment results of the assets of the Company’s retirement plans. The Financial/Planning Committee met three times during the Company’s last fiscal year.

The Nominating Committee, consisting of Messrs. Rhind (Chairman), Campbell and Ms. Bruemmer,Pyle, each an independent director, makes recommendations to the full Board with respect to candidates for Board membership, officers of the Company, and Board committee membership. The Nominating Committee does not have a charter. Generally, a diversity of factors such as general business experience, leadership and understanding and achievement in manufacturing, finance or marketing are considered in the nomination process for candidates for Board membership, although neither the Board of

3

Directors nor the Nominating Committee has established any specific minimum criteria or qualifications that a nominee must possess. The Nominating Committee will consider as prospective Board nominees persons brought to its attention by officers, directors and stockholders. Proposals may be addressed to the Nominating Committee at the address shown on the cover of this Proxy Statement, attention of the Corporate Secretary. The

3

Nominating Committee will consider candidates proposed by stockholders usingdoes not have a written charter. At a minimum, a candidate for the same evaluationBoard must demonstrate significant accomplishment in his or her field, the capacity and experience to understand the broad business operations of the Company, and the vision to assist the Company in its development and expansion. The Nominating Committee is responsible for assessing the appropriate balance of criteria as for other candidates.required of Board members. The Nominating Committee met one timetwo times during the Company’s last fiscal year.

Executive sessions of independent directors are held in connection with each regularly scheduled Board of Directors and Audit Committee meeting and at other times as necessary. The Board of Directors’ policy is to hold executive sessions without the presence of management, including the chief executive officer and other non-independent directors. The Board of Directors has determined that each of Messrs. Caldwell, Campbell, Keehn, and Rhind and Ms. Pyle are independent within the meaning of the rules of the Nasdaq National Market.

The Company does not have a formal policy regarding attendance by members of the Board of Directors at the Annual Meeting of Stockholders, although all directors are expected to attend. All members of the Board of Directors attended the Company’s 2006 Annual Meeting of Stockholders. In the Company’s last fiscal year, no director attended less than 75% of the aggregate of all meetings of the Board and all meetings held by committees of the Board on which such director served.

The Company does not have a formal policy regarding attendance by members of the Board of Directors at the Annual Meeting of Stockholders, although all directors are encouraged to attend. All members of the Board of Directors attended the Company’s 2003 Annual Meeting of stockholders.

Stockholder Communications with the Board of Directors

The Board of Directors recommends that any communications from stockholders be in writing and addressed to the Board in care of the Corporate Secretary, 2700 West Front Street, Statesville, North Carolina 28677-2927. The name of any specific intended Board member to whom a communication is intended to be addressed should be noted in the communication. The Corporate Secretary will forward such correspondence only to the intended recipient if one is noted; however, the Corporate Secretary, prior to forwarding any correspondence, will review the correspondence, and in his discretion, will not forward certain items if they are deemed frivolous, of inconsequential commercial value or otherwise inappropriate for Board consideration.

Compensation Committee Interlocks and Insider Participation

As noted above, the Compensation Committee consists of Messrs. Caldwell, Keehn and Rhind and Ms. Bruemmer.Pyle. No executive officer of the Company served as a member of the Compensation Committee or as a director of any other entity, one of whose executive officers serves on the Compensation Committee or is a director of the Company. Mr. Rhind is of counsel to the law firm of Bell, Boyd & Lloyd LLC,LLP, which serves as counsel to the Company.

Director Compensation

Each director who is not an employee of the Company receives for his services as such an annual retainer of $18,000 plus a fee of $1,000 for each day of Board and/or committee meetings attended, a daily multiple-meeting fee of $1,250 and a $500 fee for telephone meetings. In addition, the Chairmen of the Executive and Compensation Committees receive an annual fee of $2,000, and the Chairman of the Audit Committee receives an annual fee of $3,000. Payment of such fees may be deferred at the request of a director. All directors are reimbursed for their expenses for each Board and committee meeting attended. Under the Company’s 1993 Stock Option Plan for Directors, each of the Company’s non-employee directors was granted a one-time option to purchase at fair market value on the date of the grant, 5,000 shares of the Company’s common stock. These options are exercisable in 25% increments on August 1 of each of the next four years after the date of grant and have since been exercised in full by each director, with the exception of Mr. Keehn, who was granted his option in May 2001.

Non-employee directors may also elect to participate in the Company’s health insurance program at the sameno cost as for employees.to them. During the last fiscal year, Mr. Campbell and Ms. Pyle participated in this program. Directors who are employees of the Company receive no compensation for serving as directors.

4

EXECUTIVE COMPENSATION

Certain SummaryDirector Compensation InformationTable

The following table sets forth certainprovides compensation information for each of the fiscal yearsone year period ended April 30, 2004, April 30, 20032007 for each member of our Board of Directors.

Name | Fees Earned or Paid in Cash | Non-Equity Stock Awards | Option Awards | Incentive Plan Compensation | Change in Pension Value and Nonqualified Compensation Earnings | All Other Compensation | Total | |||||||||

Wiley N. Caldwell | $ | 28,000 | — | — | — | — | — | $ | 28,000 | |||||||

John C. Campbell, Jr. | 30,000 | — | — | — | — | 30,000 | ||||||||||

James T. Rhind | 32,750 | — | — | — | — | — | 32,750 | |||||||||

Silas Keehn | 31,750 | — | — | — | — | — | 31,750 | |||||||||

Margaret B. Pyle | 29,250 | — | — | — | — | 29,250 | ||||||||||

Eli Manchester, Jr. | — | — | — | — | — | — | — | |||||||||

William A. Shumaker | — | — | — | — | — | — | — | |||||||||

Messrs. Manchester and April 30, 2002, with respectShumaker are employees of the Company and receive no compensation for service as directors. Mr. Manchester receives an annual salary of $150,000 plus benefits earned under the Company’s group benefit plans. See the Summary Compensation Table for disclosure related to the compensation ofreceived by Mr. Shumaker, who also is the Chief Executive Officer of the Company.

Audit Committee Report

The Audit Committee is composed of three independent directors and is responsible for overseeing the Company’s financial reporting process and other duties as described in the Audit Committee Charter.

In fulfilling its oversight responsibilities, the Committee has reviewed and discussed the Company’s audited financial statements for the fiscal year ended April 30, 2007 with management and the Company’s four other most highly compensated executive officers (the “named executive officers”)registered independent public accounting firm. Management of the Company is responsible for those financial statements and the Company’s financial reporting process, including the Company’s system of internal controls. The independent auditors are responsible for expressing an opinion on the conformity of those financial statements with accounting principles generally accepted in all capacitiesthe United States. The Committee has discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61 relating to the conduct of the audit. The Committee has received the written disclosures and the letter from Cherry, Bekaert & Holland, L.L.P. required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees, and has discussed with Cherry, Bekaert & Holland, L.L.P. their independence. The Audit Committee also considered whether the provision of non-audit services by Cherry, Bekaert & Holland, L.L.P., if any, was compatible with maintaining its independence. Based on the Committee’s review of the audited financial statements and the review and discussions described in which they served.

SUMMARY COMPENSATION TABLEthis paragraph, the Committee recommended to the Board of Directors that the audited financial statements for the fiscal year ended April 30, 2007 be included in the Company’s Annual Report on Form 10-K for the fiscal year ended April 30, 2007 for filing with the Securities and Exchange Commission. All members of the Committee meet the independence standards established by the Nasdaq Stock Market, Inc.

|

| ||||||||||||

|

| ||||||||||||

| |||||||||||||

| |||||||||||||

| |||||||||||||

James | |||||||||||||

| |||||||||||||

5

Option Grants in Last Fiscal YearINDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

On July 8, 2005, the Company dismissed PricewaterhouseCoopers LLP (“PwC”) as the Company’s independent registered public accounting firm. This dismissal, which was immediately effective, was approved by the Audit Committee of the Board of Directors of the Company.

The reports of PwC on the financial statements of the Company didfor the year ended April 30, 2005 contained no adverse opinion or disclaimer of opinion and were not grantqualified or modified as to uncertainty, audit scope or accounting principle.

During the year ended April 30, 2005, there were no disagreements with PwC on any stock optionsmatter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of PwC, would have caused PwC to make reference thereto in its reports on the financial statements of the Company for such years.

During the year ended April 30, 2005 and through July 8, 2005, there were no reportable events (as defined in Item 304(a)(1)(v) of Regulation S-K).

Also on July 8, 2005, the Company engaged Cherry, Bekaert & Holland, L.L.P. (“CB&H”) as its new independent registered public accounting firm to audit the Company’s financial statements for the year ended April 30, 2006 and to review the financial statements to be included in the Company’s quarterly reports on Form 10-Q, beginning with the quarter ended July 31, 2005. The decision to engage CB&H was approved by the Company’s Audit Committee.

Prior to the engagement of CB&H, neither the Company nor anyone on behalf of the Company consulted with CB&H during the Company’s two most recent fiscal year 2004.years and through July 8, 2005, in any manner regarding either: (A) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s financial statements; or (B) any matter that was the subject of either a disagreement or a reportable event (as defined in Item 304(a)(1)(iv) and (v), respectively, of Regulation S-K).

It is expected that a representative of Cherry, Bekaert & Holland, L.L.P. will be present at the Annual Meeting of Stockholders to be held on August 22, 2007 to answer any appropriate questions and such representative will have an opportunity to make a statement if he or she desires.

Option ExercisesPolicy on Audit Committee Pre-Approval of Audit and HoldingsNon-Audit Services

The following table sets forth certain information with respectAudit Committee’s policy is to options exercised during fiscal year 2004pre-approve all audit and non-audit services to be provided by the named executive officers andCompany’s independent auditors on a case-by-case basis. In making such determination, the Audit Committee considers whether the provision of non-audit services is compatible with respect to options held atmaintaining the endauditor’s independence. All of the year.audit and non-audit services provided by the Company’s independent auditors on behalf of the Company in 2007, 2006, and 2005 were pre-approved in accordance with this policy.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND OPTION VALUES AT FISCAL YEAR-END

| Shares Acquired on Exercise | Value Realized ($) (1) | Number of Securities Underlying Unexercised Options at April 30, 2004 | Value of Unexercised In-the-Money Options at April 30, 2004 ($) (2) | |||||||||

Name | Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||

William A. Shumaker | — | — | 26,125 | 14,375 | 21,849 | 18,253 | ||||||

D. Michael Parker | 1,000 | 4,090 | 19,750 | 8,750 | 21,939 | 11,019 | ||||||

Kurt P. Rindoks | — | — | 12,500 | 4,500 | 9,964 | 5,576 | ||||||

James J. Rossi | 2,000 | 8,715 | 14,500 | 4,500 | 23,534 | 5,576 | ||||||

Kenneth E. Sparks | — | — | 6,250 | 4,250 | 4,208 | 5,443 | ||||||

6

Retirement PlanAudit Fees and Non-Audit Fees

The named executive officersfollowing fees were paid or will be paid to the Company’s independent registered public accounting firm for professional services rendered on behalf of the Company participate inrelated to the Company’s Retirement Plan. The Retirement Plan provides retirement benefits for participating employees which are calculated with reference to years of service and final average monthly compensation (salary and bonus). The annual benefit amount is calculated as 40%past two fiscal years:

| 2007 | 2006 | |||||

Audit of Financial Statements | $ | 79,000 | $ | 75,000 | ||

Audit-Related Services | 16,500 | 15,750 | ||||

All Other Fees | — | — | ||||

Total | $ | 95,500 | $ | 90,750 | ||

Audit services consisted of the 10-year final average annual compensation minus 50% of the Primary Social Security Benefit, all multiplied by a fraction, the numerator of which is the number of years of credited service up to 30 years, and the denominator of which is 30. Participants in the Retirement Plan may elect among several payment alternatives.

The following table shows estimated annual benefits payable to employees with the indicated years of service and final average annual compensation. The estimated annual benefits are based upon the assumption that the Retirement Plan will continue in effect, without change, that the participant retires at age 65, and that the participant does not elect any alternate payment option under the Retirement Plan. To the extent ERISA rules restrict the amount otherwise payable under the Plan, the amount in excess of the restrictions will be paid by the Company under the provisionsaudit of the Company’s Pension Equalization Plan. At April 30, 2004,annual consolidated financial statements and the credited yearsreview of service under the Retirement PlanCompany’s quarterly financial statements. Audit-related services consisted of fees for Messrs. Shumaker, Parker, Rindoks, Rossi, and Sparks were 10.6, 13.7, 19.5, 20.5, and 6.6, respectively.

Final Average Compensation | Years of Service | |||||||||||||||||

| 10 | 15 | 20 | 25 | 30 | 35 | |||||||||||||

$500,000 | $ | 63,100 | $ | 94,650 | $ | 126,200 | $ | 157,750 | $ | 189,300 | $ | 189,300 | ||||||

400,000 | 49,770 | 74,650 | 99,530 | 124,410 | 149,300 | 149,300 | ||||||||||||

300,000 | 36,430 | 54,650 | 72,860 | 91,080 | 109,300 | 109,300 | ||||||||||||

200,000 | 23,100 | 34,650 | 46,200 | 57,750 | 69,300 | 69,300 | ||||||||||||

100,000 | 9,770 | 14,650 | 19,530 | 24,410 | 29,300 | 29,300 | ||||||||||||

In accordance with rules promulgated by the Securities and Exchange Commission, the information included under the captions “Compensation Committee Report on Executive Compensation”, “Audit Committee Report” and “Performance Graph” will not be deemed to be filed or to be proxy soliciting material or incorporated by reference in any prior or future filings by the Company under the Securities Actaudits of 1933 or the Securities Exchange Actfinancial statements of 1934.employee benefit plans.

7

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATIONDISCUSSION AND ANALYSIS

TheExecutive compensation is administered by the Compensation Committee of the Board, which is composed of four independent directors, considers and provides recommendations to the full Board of Directors with respect to salaries and other compensation programs for executive officers of the Company.

directors.

The objective of the Company’s executive compensation program is to attract, motivate, reward and retain management talent critical to the Company’s achievement of its objectives. Salaries and other compensation for the Company’s executive officers are based on each executive officer’s responsibilities, level of experience, and performance over time, as well as on the recommendation of the Chief Executive Officer. In order to assure that salaries and compensation remain competitive, the Company subscribes to and consults various published surveys on executive compensation.

Section 162(m) of the Internal Revenue Code of 1986, as amended, limits the deduction for federal income tax purposes of certain compensation paid by any publicly-held corporation to its chief executive officer and its four other most highly compensated executive officers to $1 million per year for each such executive. This deduction limit is not relevant toBecause the Company at the current levels of compensation of its executive officers.officers traditionally have been well below the deduction limit, the Company has not adopted a formal policy with respect to Section 162(m).

Executive Officer Compensation

The four principal components of the Company’s compensation program for executive officers has four principal components which are discussed below.

Base Salary

The Compensation Committee annually reviews the base salaries of executive officers. Prior to the meeting at which the annual review occurs, the Committee is provided (i) information furnished withby the Company’s human resources department on historical data on the base and total compensationcompensations for each executive, and marketplace compensation data, including both base and incentive compensation data, for comparable positions at other manufacturing and service companies with generally similar annual sales volume, and (ii) individual performance appraisals and recommended adjustments byfrom the Chief Executive Officer for each executive officer, except himself. The human resources department also provides a base salary range for each executive officer, which shows a minimum, mid-point, and maximum salary, and the position of the executive officer’s base salary in this range. The base salary range is established using marketplace comparison data and the individual responsibilities of the executive officer’s position, and is updated each year for inflation. The Company

7

typically targets base salaries at the mid-point of the Company’s established range for a position. The Committee further considers, on a subjective basis, the executive officer’s particular qualifications, level of experience, and sustained performance over time, and pay position within his or her established base salary range.time. These same factors are also considered in determining an adjustment to the salary of the Chief Executive Officer. Base salaries are traditionally adjusted as of July 1 of each year.

Annual Incentive Compensation

All of the Company’s executive officers are eligible to participate in an annual incentive bonus plan, pursuant to which each executive officer is eligible to earn a cash bonus for each fiscal year of the Company, based primarily on the attainment of earnings goals established in the incentive bonus plan and, to a lesser extent, on the executive officer’s achievement of established personal goalsobjectives to the degree determined by the Board of Directors upon the recommendation of the Chief Executive Officer.

At the beginning of each fiscal year, the Board of Directors approves earnings goals for the Company for such year and, upon recommendation of the Compensation Committee, establishes specified percentages of each executive officer’s beginning-of-the-year base salary that will be available for bonuses if the Company and/or its operating businesses achieves specified earnings goals and the executive officer achieves his or her personal goals. The Board of Directors generally attempts to establish annual earnings goals at target levels it believes are challenging, but achievable, with earnings above target levels considered to be relatively difficult to achieve. In determining the level of available bonuses for each executive officer, many of the same factors considered in determining an executive officer’s base salary are also considered by the Committee.

For fiscal year 2007, the specified bonus percentages increase as the earnings reach various established levels. Nofor executive officers qualifiedother than the Chief Executive Officer ranged from 10% of an executive officer’s base salary, if the Company achieved 90% of targeted earnings for cash bonuses under the incentive bonus planyear, increasing to a maximum of 25% of an executive’s base salary, as earnings reached 130% of targeted earnings. The corresponding specified percentages for fiscal year 2004.the Chief Executive Officer were from 20% to a maximum of 30%.

8

Long-Term Incentive Plans

In recent fiscal years, throughThrough fiscal year 2003, the Company used stock options as its primary long-term incentive plan for executive officers. Stock option awards were normally made annually in August by the Board of Directors, based on the recommendations of the Chief Executive Officer, with respect to all stock options other than his own, and the Compensation Committee. The exercise price of the granted stock options was the fair market value of the Company’s common stock on the date of the grant. Individual awards were based on an individual’s performance, his or her comparative base salary level and the number of stock option grants previously made.

Beginning with fiscal year 2004, the Company has used a performance-based long-term incentive plan, instead of stock options, as its primary long-term incentive plan for its executive officers. Under this plan, performance stock appreciation rights (“PSARs”) are normally granted annually in May by the Board of Directors to participating employees. This plan provides executive officers an opportunity to receive awards in the form of cash payments at the end of a three-year performance period based upon the occurrence of both (i) the Company’s attainment of specified annual financial goals established by the Board of Directors and (ii) an increase in the market price of the Company’s stock from the beginning to the end of the three-year period. No PSARs or stock options were granted in fiscal year 2007.

8

Other Compensation Plans

The executive officers of the Company participate in the Company’s Pension Plan. The Plan provides retirement benefits for participating employees. The annual benefit amount is calculated as 40% of the 10-year final average annual compensation (salary and bonus) minus 50% of the Primary Social Security Benefit, all multiplied by a fraction, the numerator of which is the number of years of credited service up to 30 years, and the denominator of which is 30. Participants in the Plan may elect among several payment alternatives. As of April 30, 2005, the Company “froze” the benefits under the Plan. As a result, no further benefits will be earned by current participants under the Plan after that date and no additional participants will be added to the Plan. To the extent ERISA rules restricted the amount otherwise payable under the Plan, the benefit amount in excess of the restrictions will be paid by the Company under the provisions of the Company’s non-qualified Pension Equalization Plan.

The Company has a 401k Incentive Savings Plan (the “401k Plan”) which covers substantially all salaried and hourly employees, including all of the executive officers. The plan provides benefits to all employees who have attained age 21, completed three months of service, and who elect to participate. Under terms of the plan, the Company makes matching contributions equal to 100% of the employee’s qualifying contribution up to 3% of the employee’s compensation, and makes matching contributions equal to 50% of the employee’s contributions between 3% and 5% of the employee’s compensation, resulting in a maximum employer contribution equal to 4% of the employee’s compensation. Additionally, the Company makes a non-matching contribution for participants employed by the Company on December 31 of each year equal to 1% of the participant’s qualifying compensation for that calendar year.

The Company also has a non-qualified 401+ Deferred Compensation Plan (the “401+ Plan”), which supplements the 401k Plan. The 401+ Plan was adopted to provide highly compensated employees an alternative retirement plan because income tax laws restrict the amount of contributions executives may otherwise have contributed to the 401k Plan. The 401+ Plan operates similarly to the 401k Plan, in that the Company makes matching credits to the participant’s account in an amount equal to 50% of the compensation deferred by the participant (up to 6% of the participant’s compensation). Amounts deferred under the plan will be distributed to the participant after the participant’s termination of employment with the Company in cash in a lump sum or installments at a time previously elected by the participant. All of the Company’s executive officers participated in the 401k Plan and the 401+ Plan in fiscal year 2007, with the exception of Mr. Rindoks, who did not participate in the 401+ Plan.

Each of the Company’s executive officers is entitled to receive additional compensation in the form of payments, allocations, or accruals under various other group compensation and benefit plans.plans on the same basis as other employees. Benefits under these plans are not directly, or indirectly, tied to employee or Company performance.

Chief Executive Officer Compensation

The Compensation Committee considers the Chief Executive Officer’s leadership an important factor in the future success of the Company. The compensation of the CEO has traditionally included base salary, annual incentive compensation, long-term incentive compensation, and benefits under various group plans. In establishing Mr. Shumaker’s base salary for each fiscal year, the Compensation Committee considers operating results for the prior year and the outlook for the current year, continued development of the management team, operational improvements, compensation of chief executive officers of other companies with comparable sales, a review of his base salary in relation to the range for his position established by the human resources department, and the price of the Company’s common stock. At Mr. Shumaker’s request, his base salary remained unchanged for fiscal year 2004. The CEO’s annual incentive compensation and long-term incentive compensation are determined pursuant to the Company’s incentive plans for executive officers. Mr. Shumaker did not earnearned a cash bonus in the amount of $69,670, or 24% of his May 1, 2006 base salary, under the annual incentive bonus plan for fiscal year 2004, as2007. The bonus amount was based on the Company did not meet itslevel of earnings attained for the year and his achievement of established earnings goals.

Compensation Committee Members

Wiley N. Caldwell, Chairman

Margaret Barr Bruemmer

Silas Keehn

James T. Rhindpersonal goals during the year.

9

AUDIT COMMITTEE REPORTCompensation Committee Report

The Audit Committee is composed of three independent directors and is responsible for overseeing the Company’s financial reporting process and other duties as described in the Audit Committee Charter attached as Appendix A to this Proxy Statement.

In fulfilling its oversight responsibilities, the Committee hasWe have reviewed and discussed with management the Compensation Discussion and Analysis to be included in the Company’s audited financial statements for the fiscal year ended April 30, 2004 with management and the Company’s independent auditors. Management2007 Shareholder Meeting Schedule 14A Proxy Statement, to be filed pursuant to Section 14(a) of the Company is responsible for those financial statements and the Company’s financial reporting process, including the Company’s system of internal controls. The independent auditors are responsible for expressing an opinion on the conformity of those financial statements with accounting principles generally accepted in the United States. The Committee has discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61 relating to the conduct of the audit. The Committee has received the written disclosures and the letter from PricewaterhouseCoopers LLP required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees, and has discussed with PricewaterhouseCoopers LLP their independence. The Audit Committee also considered whether the provision of non-audit services by PricewaterhouseCoopers LLP was compatible with maintaining its independence.Exchange Act. Based on the Committee’s review of the audited financial statements and the review and discussions described in this paragraph, the Committee recommendedreferred to above, we recommend to the Board of Directors that the audited financial statements for the fiscal year ended April 30, 2004Compensation Discussion and Analysis referred to above be included in the Company’s Annual Report on Form 10-K for the fiscal year ended April 30, 2004 for filing with the Securities and Exchange Commission. All members of the Committee meet the independence requirements established by The Nasdaq Stock Market, Inc.Proxy Statement.

Compensation Committee Members Wiley N. Caldwell, Chairman Margaret B. Pyle Silas Keehn James T. Rhind COMPENSATION TABLES Summary Compensation Table for Fiscal Year 2007 Name and Principal Position Salary ($) Bonus ($) Stock Awards Option Awards Non-Equity Incentive Plan Compensation ($) Change in Pension Value And Nonqualified Deferred Compensation Earnings ($)(1) All Other Compensation ($) (2) Total ($) William A. Shumaker President and Chief Executive Officer D. Michael Parker Senior Vice President, Finance Chief Financial Officer, Treasurer and Secretary Kurt P. Rindoks Vice President, Engineering & Product Development Keith D. Smith Vice President, Manufacturing Sudhir K. (Steve) Vadehra Vice President, International Operations 10Audit ChairmanJohn C. Campbell, Jr. 303,333 69,642 — — — 13,045 27,175 413,195 201,063 38,112 — — — 8,351 15,964 263,490 156,417 22,646 — — — 6,884 7,742 193,689 140,250 17,306 — — — 1,095 11,025 169,676 153,434 31,011 — — — 4,016 20,407 208,868 (1) The amount listed for each named executive officer consists of the current year change in the present value of benefits earned under the Pension Plan. Mr. Shumaker’s amount also includes a change of $2,343 during the year in the present value of his benefits earned under the Pension Equalization Plan. No benefits were earned under the Pension Plan during the year. See the Pension Benefits section of this Proxy Statement for additional information regarding the Pension Plan and the Pension Equalization Plan. (2) The amount listed for each named executive officer consists of the total matching contributions made by the Company during the year on behalf of that executive officer to the Company’s 401k Incentive Savings Plan and 401+ Deferred Compensation Plan. Mr. Vadehra’s amount also includes an automobile allowance in the amount of $7,753.

PERFORMANCE GRAPHOption and PSAR Grants in Fiscal Year 2007

The Company did not make any option or PSAR grants during fiscal year 2007.

Outstanding Equity and PSAR Awards at Fiscal Year-End

| Option Awards | PSAR Awards (1) | |||||||||||

Name | Number of Securities Underlying Unexercised Options- Exercisable (#) | Number of Securities Underlying Unexercised Options- Unexercisable (#) | Option Exercise Price ($) | Option Expiration Date | Number of PSARs That Have Not Vested (#) | Market Value of PSARs That Not Vested ($) | ||||||

William A. Shumaker | 2,500 | — | 8.125 | 8/27/07 | 5,334 | 15,842 | ||||||

| 5,000 | — | 12.000 | 8/26/08 | |||||||||

| 5,000 | — | 10.375 | 8/25/09 | |||||||||

| 7,500 | — | 10.125 | 8/23/10 | |||||||||

| 10,000 | — | 9.550 | 8/22/11 | |||||||||

| 10,000 | — | 9.100 | 8/28/12 | |||||||||

D. Michael Parker | 2,500 | — | 8.125 | 8/27/07 | 2,666 | 7,918 | ||||||

| 4,000 | — | 12.000 | 8/26/08 | |||||||||

| 4,000 | — | 10.375 | 8/25/09 | |||||||||

| 5,000 | — | 10.125 | 8/23/10 | |||||||||

| 6,000 | — | 9.550 | 8/22/11 | |||||||||

| 6,000 | — | 9.100 | 8/28/12 | |||||||||

Kurt P. Rindoks | 2,000 | — | 8.125 | 8/27/07 | 1,334 | 3,962 | ||||||

| 3,000 | — | 12.000 | 8/26/08 | |||||||||

| 3,000 | — | 10.375 | 8/25/09 | |||||||||

| 3,000 | — | 10.125 | 8/23/10 | |||||||||

| 3,000 | — | 9.550 | 8/22/11 | |||||||||

| 3,000 | — | 9.100 | 8/28/12 | |||||||||

Keith D. Smith | 500 | — | 12.000 | 8/26/08 | 1,000 | 2,970 | ||||||

| 600 | — | 10.375 | 8/25/09 | |||||||||

| 600 | — | 10.125 | 8/23/10 | |||||||||

| 600 | — | 9.550 | 8/22/11 | |||||||||

| 450 | — | 9.100 | 8/28/12 | |||||||||

Sudhir K. (Steve) Vadehra | — | — | — | — | — | — | ||||||

| (1) | The PSAR Awards included in the table above are described in “Compensation Discussion and Analysis – Long-Term Incentive Plans.” |

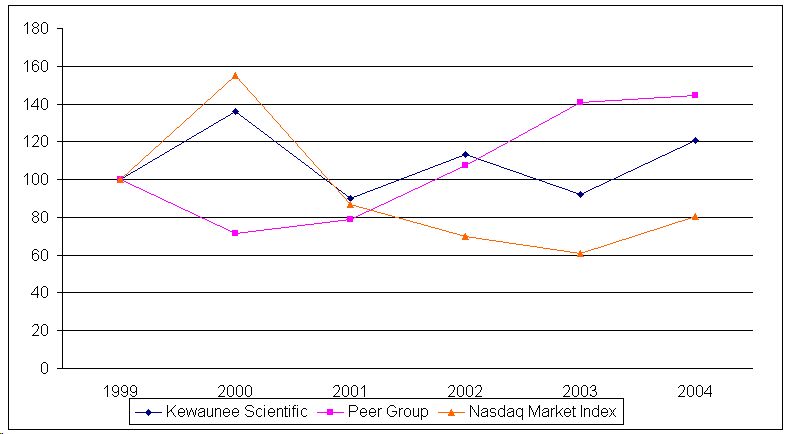

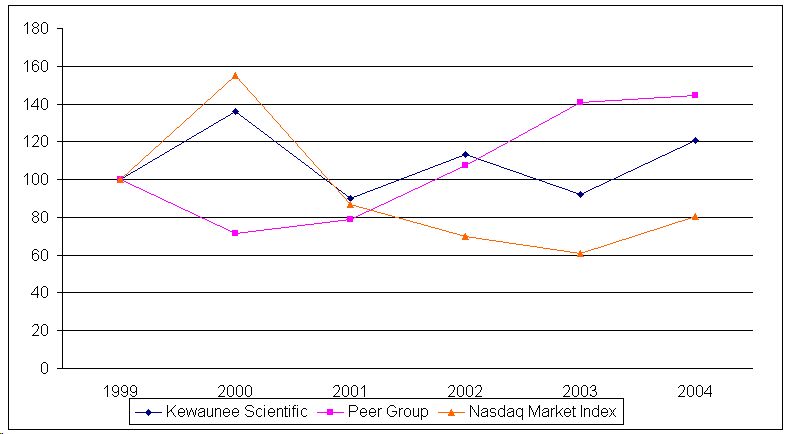

The graph below sets forth a comparison of the Company’s annual stockholder return with the annual stockholder return of (i) the Nasdaq Market Index,Option Exercises and (ii) an index of Nasdaq, non-financial companies with similar market capitalizations to the Company1. The graph is based on an investment of $100 on May 1, 1999 (the first trading day of the Company’s fiscal year beginning on that date)Stock Vested in the Company’s common stock, assuming dividend reinvestment. The graph is not an indicator of the future performance of the Company. Thus, it should not be used to predict the future performance of the Company’s stock. The graph and related data were furnished by CoreData, Richmond, Virginia.Fiscal Year 2007

Comparison of 5-Year Cumulative Total Return

Kewaunee Scientific Corporation, Nasdaq Market Index

and Similar Market Capitalization Index

| Option Awards | Stock Awards | |||||||

Name | Number of Shares Acquired on Exercise (#) | Value Realized on Exercise ($) | Number of Shares Acquired on Vesting (#) | Value Realized on Vesting ($) | ||||

William A. Shumaker | 500 | 1,413 | — | — | ||||

D. Michael Parker | — | — | — | — | ||||

Kurt P. Rindoks | — | — | — | — | ||||

Keith D. Smith | — | — | — | — | ||||

Sudhir K. (Steve) Vadehra | — | — | — | — | ||||

11

Nonqualified Deferred Compensation for Fiscal Year 2007

The following table provides information regarding the Company’s 401+ Deferred Compensation Plan. See additional discussion of this plan in “Compensation Discussion and Analysis – Executive Officer Compensation - Other Compensation Plans.”

Name | Executive Contributions in Last FY | Company Contributions in Last FY (1) | Aggregate Earnings in Last FY | Aggregate Withdrawals/ Distributions | Aggregate Balance at Last FYE | |||||||||

William A. Shumaker | $ | 18,150 | $ | 13,075 | $ | 19,829 | — | $ | 295,769 | |||||

D. Michael Parker | 12,032 | 6,613 | 22,049 | — | 292,573 | |||||||||

Kurt P. Rindoks | — | — | 11,979 | — | 148,412 | |||||||||

Keith D. Smith | 8,175 | 4,504 | 5,132 | — | 54,327 | |||||||||

Sudhir K. (Steve) Vadehra | 15,271 | 5,595 | 4,925 | — | 116,280 | |||||||||

| (1) | These amounts also were reported in the Summary Compensation Table under the column entitled “All Other Compensation.” |

Equity Compensation Plans

The following table summarizes information about the Company’s equity compensation plans as of April 30, 2007. All outstanding awards relate to the Company’s common stock.

Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants, and rights | Weighted-average exercise price of outstanding options, warrants, and rights | Number of securities remaining | ||||

Equity compensation plans approved by stockholders | 157,350 | $ | 10.03 | 41,100 | |||

Equity compensation plans not approved by stockholders | — | — | — | ||||

Total | 157,350 | $ | 10.03 | 41,100 | |||

| (1) | Represents shares available for future issuance under the Company’s 2000 Key Employee Stock Option Plan. No options were available for grant under any of the other equity compensation plans of the Company. |

12

Pension Benefits

The following table shows the present value of the accumulated benefit payable to executives participating in the Pension Plan and Pension Equalization Plan as of April 30, 2007 with the indicated years of service. The value of benefits was determined using a discount rate of 6.0%. For these calculations, each named executive is assumed to live to and retire at the normal retirement age of 65, as defined by the plans. All other assumptions used in determining the present value of benefits are the same assumptions used for financial reporting purposes.

Name | Plan Name | Number Of Years Credited Service (#) (1) | Present Value of Accumulated Benefit ($) (2) | |||

William A. Shumaker | Pension Plan Pension Equalization Plan | 11.6 11.6 | 189,065 41,392 | |||

D. Michael Parker | Pension Plan Pension Equalization Plan | 14.7 14.7 | 147,544 — | |||

Kurt P. Rindoks | Pension Plan Pension Equalization Plan | 20.5 20.5 | 121,623 — | |||

Keith D. Smith | Pension Plan Pension Equalization Plan | 12.3 12.3 | 19,436 — | |||

Sudhir K. (Steve) Vadehra | Pension Plan Pension Equalization Plan | 6.2 6.2 | 70,962 — |

13

Payments Upon Termination or Change in Control

This following table includes information regarding the estimated amount of payments and other benefits each named executive officer would receive if his employment with the Company was terminated on April 30, 2007.

Name and Benefits | For Cause or Voluntary termination other than for Good Reason ($) | Termination Without Cause and no Change in Control ($) | Termination without Cause after Change in Control ($) | ||||

William A. Shumaker Base salary Annual bonus (1) Pension Equalization Plan 401+ Deferred Compensation Plan Life insurance benefit Medical & disability insurance | — 69,642 — — — — | 305,000 69,642 — — — — | 610,000 116,089 41,392 58,087 85,051 21,453 | (2) | |||

Total | 69,642 | 374,642 | 932,072 | ||||

D. Michael Parker Base salary Annual bonus (1) Pension Equalization Plan 401+ Deferred Compensation Plan Life insurance benefit Medical & disability insurance | — 38,112 — — — — | 198,300 38,112 — — — — | 396,600 63,266 — 36,789 44,228 19,642 | (2) | |||

Total | 38,112 | 236,412 | 560,525 | ||||

Kurt P. Rindoks Base salary Annual bonus (1) Pension Equalization Plan 401+ Deferred Compensation Plan Life insurance benefit Medical & disability insurance | — 22,646 — — — — | 157,200 22,646 — — — — | 157,200 30,119 — 9,366 1,471 13,768 | (2) | |||

Total | 22,646 | 179,846 | 211,924 | ||||

Keith D. Smith Base salary Annual bonus (1) Pension Equalization Plan 401+ Deferred Compensation Plan Life insurance benefit Medical & disability insurance | — 17,306 — — — — | 141,000 17,306 — — — — | 141,000 23,069 — 13,126 1,320 7,227 | (2) | |||

Total | 17,306 | 158,306 | 185,741 | ||||

Sudhir K. (Steve) Vadehra Base salary Annual bonus (1) Pension Equalization Plan 401+ Deferred Compensation Plan Life insurance benefit Medical & disability insurance | — 31,011 — — — — | 120,923 31,011 — — — — | 120,923 31,011 — — — — | | |||

Total | 31,011 | 151,934 | 151,934 | ||||

| (1) | The Annual Bonus amount shown includes the following bonus earned by the executive officers in fiscal year 2007, but not paid until after April 30, 2007: Shumaker - $69,642, Parker - $38,112, Rindoks - $22,646, Smith - $17,306, and Vadehra - $31,011. |

| (2) | Represents the additional Company matching contributions the executive officer would have earned under both the 401+ Deferred Compensation Plan and the 401k Incentive Savings Plan for the base salary and annual bonus amounts shown. |

14

AGREEMENTS WITH CERTAIN EXECUTIVES

The Company entered into agreementsChange of Control Employment Agreements (the “Agreements”) with (i) Messrs. Shumaker, Parker, Rindoks, and RossiRindoks in fiscal year 2000, thatand (ii) with Messrs. Smith; Dana Dahlgren, Vice President of Sales and Marketing- Laboratory Products Group; and David M. Rausch, Vice President, Construction Services, in fiscal year 2005. These agreements provide for the payment of compensation and benefits in the event of termination of their employment within three years following a Change of Control of the Company, as defined in the agreements. Agreements.

Each executive officer whose employment is so terminated will receive compensation if the termination of his employment was by the Company or its successor without cause, or by the executive officer for good reason, as defined in the agreements. Upon such a termination of employment within one year following a Change of Control, the Company or its successor will be required to make, in addition to unpaid ordinary compensation and a lump-sum cash payment for certain benefits, a lump-sum cash payment equal to the executive’sexecutive officer’s annual compensation with respect to Messrs. Rindoks, Smith, Dahlgren and RossiRausch and two (2) times the executive’sexecutive officer’s annual compensation with respect to Messrs. Shumaker and Parker. Upon a termination of employment occurring after the first anniversary, but within three years, of the date of the Change of Control, in addition to unpaid ordinary compensation and a lump-sum cash payment for certain benefits, Messrs. Rindoks, Smith, Dahlgren and RossiRausch will be entitled to a lump-sum payment equal to one-half (1/2) of their annual compensation and Messrs. Shumaker and Parker will be entitled to a lump-sum payment equal to their annual compensation. See “Compensation Tables - Payments upon Termination or Change in Control” for other entitlements for the named executive officers under terms of the Agreements.

In August 2004, the Company entered into an employment letter agreement with K. Bain Black, Vice President and General Manager of the Technical Products Group, which provides that if he is terminated without cause, the Company will be obligated to pay him separation pay equal to his current base salary for nine (9) months, reduced by any income earned by him during the payment period.

Kewaunee Labway Asia Pte. Ltd., a dealer for the Company’s products in Singapore, is a joint venture formed in June 1998 between the Company and an entity controlled by Mr. Vadehra. The Company owns 51% of Kewaunee Labway Asia and the entity controlled by Mr. Vadehra owns the remaining 49% interest. Mr. Vadehra was elected Vice President of International Operations of the Company in June 2004. He has also served as the Managing Director of Kewaunee Labway Asia since its formation in 1998.

1215

SECURITY OWNERSHIP OF DIRECTORS AND EXECUTIVE OFFICERS

The following table contains information with respect to the “beneficial ownership” (as defined by the Securities and Exchange Commission) of shares of the Company’s common stock, as of June 30, 2004,July 5, 2007, by (i) each director and director nominee, (ii) each of the named executive officers and (iii) all directors and executive officers as a group. Except as otherwise indicated by footnote, the shares shown are held directly with sole voting and investment power.

Name | Shares beneficially owned (1) | Percent class | Shares beneficially owned (1) | Percent of class | ||||||

Margaret Barr Bruemmer (2) | 92,119 | 3.7 | % | |||||||

Margaret B. Pyle (2) | 55,409 | 2.2 | % | |||||||

Wiley N. Caldwell | 5,500 | * | 5,500 | * | ||||||

John C. Campbell, Jr. (3) | 41,667 | 1.7 | % | 41,667 | 1.7 | % | ||||

Silas Keehn | 10,000 | * | 5,000 | * | ||||||

Eli Manchester, Jr. | 126,000 | 5.0 | % | 126,000 | 5.0 | % | ||||

James T. Rhind (4) | 391,351 | 15.7 | % | 391,350 | 15.6 | % | ||||

William A. Shumaker (5) | 62,786 | 2.5 | % | 70,286 | 2.8 | % | ||||

D. Michael Parker (6) | 40,500 | 1.6 | % | 40,500 | 1.6 | % | ||||

Keith D. Smith | 2,750 | * | ||||||||

Kurt P. Rindoks | 20,535 | * | 20,000 | * | ||||||

James J. Rossi | 25,750 | * | ||||||||

Kenneth E. Sparks | 8,250 | * | ||||||||

Directors and executive officers as a group (11 persons) | 824,458 | 31.6 | % | |||||||

Sudhir K. (Steve) Vadehra | — | — | ||||||||

Directors and executive officers as a group (14 persons) | 766,212 | 29.3 | % | |||||||

| * | Percentage of class is less than 1%. |

| (1) | Includes shares which may be acquired within sixty (60) days from |

| (2) | Includes |

| (3) | Includes |

| (4) | Includes |

| (5) | Includes |

| (6) | Includes |

1316

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table contains information with respect to the “beneficial ownership” (as defined by the Securities and Exchange Commission) of shares of the Company’s common stock, as of June 30, 2004,July 5, 2007, by each person who is known by management of the Company to have been the “beneficial owner” of more than five percent of such stock as of such date, other than persons identified above under “Security Ownership of Directors and Executive Officers”.date. Except as otherwise indicated by footnote, the shares shown are held with sole voting and investment power.

Name | Shares beneficially owned | Percent class | Shares beneficially owned | Percent class | ||||||||

Elizabeth B. Gardner | 212,069 | (1) | 8.5 | % | 212,069 | (1) | 8.5 | % | ||||

Laura Campbell Rhind | 391,351 | (2) | 15.8 | % | 391,350 | (2) | 15.6 | % | ||||

Ernest and Patricia R. Ohnell | 166,700 | (3) | 6.7 | % | 166,700 | (3) | 6.6 | % | ||||

Dimensional Fund Advisors LP | 125,752 | (4) | 5.0 | % | ||||||||

| (1) | Includes 64,093 shares held by Mrs. Gardner as a trustee of certain irrevocable trusts for the benefit of her children, as to which shares she disclaims beneficial ownership, and 12,925 shares held by Mrs. Gardner’s |

| (2) | Includes 44,080 shares held as trustee and beneficiary of a trust under the will of Ruth Haney Campbell, as to which shares Mrs. Rhind shares voting and investment power, 92,192 shares held by Mr. Rhind personally or as trustee and 12,000 shares held by a charitable foundation of which Mr. and Mrs. Rhind are two of three directors. Mr. and Mrs. Rhind and a third director share voting and investment power over the shares held by the charitable foundation, but disclaim beneficial ownership of them. Mrs. Rhind’s address is 830 Normandy Lane, Glenview, Illinois 60025. |

| (3) | The shares owned by Ernest and Patricia R. Ohnell listed in the table are shown as being owned as of February 29, 2000 according to a Schedule 13D filed with the Securities and Exchange Commission in March 2000. Ernest Ohnell directly owned 127,700 shares and his wife, Patricia Ohnell, directly owned 39,000 shares. The Ohnells’ address is 75 Khakum Road, Greenwich, Connecticut 06831. |

| (4) | The shares owned by Dimensional Fund Advisors listed in the table are shown as being owned as of December 31, 2006 according to a Schedule 13G filed with the Securities and Exchange Commission in February 2007. Dimensional Fund Advisors’ address is 1299 Ocean Avenue, Santa Monica, California 90401. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s executive officers, directors and 10% stockholders to file reports of ownership with the Securities and Exchange Commission. Such persons also are required to furnish the Company with copies of all Section 16(a) forms they file. Based solely on its review of copies of such forms received by it and inquiries of such persons, other than with respect to one late report filed by James Rossi regarding the sale of 1,077 shares of the Company’s common stock, the Company believes that all such filing requirements applicable to its executive officers, directors and 10% stockholders were complied with.

1417

INDEPENDENT AUDITORS

PricewaterhouseCoopers LLP has been selected by the Audit Committee of the Board of Directors to act as the Company’s independent auditors for the fiscal year ending April 30, 2005. PricewaterhouseCoopers LLP served as independent auditors for the Company for the fiscal year ended April 30, 2004. A representative of PricewaterhouseCoopers LLP is expected to attend the annual meeting and will be afforded an opportunity to make a statement if he desires to do so and to respond to questions by stockholders.

Policy on Audit Committee Pre-Approval of Audit and Non-Audit Services

The Audit Committee’s policy is to pre-approve all audit and non-audit services to be provided by the Company’s independent auditors on a case-by-case basis. In making such determinations, the Audit Committee considers whether the provision of non-audit services is compatible with maintaining the auditor’s independence. All of the audit and non-audit services provided by the Company’s independent auditors on behalf of the Company in 2004 and 2003 were pre-approved in accordance with this policy.

Audit Fees and Non-Audit Fees

The following fees were paid or will be paid to PricewaterhouseCoopers LLP for professional services rendered on behalf of the Company related to the past two fiscal years:

| 2004 | 2003 | |||||

Audit Fees | 79,500 | 74,000 | ||||

Audit-Related Fees | 12,500 | 12,500 | ||||

Tax Fees | 34,978 | 26,000 | ||||

Total | $ | 126,978 | $ | 112,500 | ||

For each of 2004 and 2003, audit services consisted of the audit of the Company’s annual consolidated financial statements and the review of the Company’s quarterly financial statements. Audit-related services included benefit plan audits. Tax services included federal and state tax compliance and research.

PROXIES AND VOTING AT THE MEETING

The expense of solicitation of proxies is to be paid by the Company. The Company will also reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable expenses in sending proxies and proxy material to the beneficial owners of the Company’s common stock.

At the close of business on July 6, 2004,5, 2007, the record date for determination of stockholders entitled to vote at the annual meeting, there were 2,490,2702,507,770 shares of common stock of the Company outstanding and entitled to vote.

Each share of common stock is entitled to one vote. Any stockholder giving a proxy has the power to revoke it at any time before it is voted, by written notice to the Secretary, by delivery of a later-dated proxy or in person at the meeting.

The holders of a majority of the total shares of common stock issued and outstanding, whether present in person or represented by proxy, will constitute a quorum for the transaction of business at the

15

meeting. The vote of a plurality of the shares represented at the meeting, in person or by proxy, is required to elect the two nominees for director. Approval of any other matter submitted to the stockholders for their consideration at the meeting requires the affirmative vote of the holders of a majority of the shares of common stock represented at the meeting, in person or by proxy, and entitled to vote. Abstentions, directions to withhold authority, and broker non-votes are counted as shares present in the determination of whether the shares of stock represented at the meeting constitute a quorum. Abstentions, directions to withhold authority, and broker non-votes are not counted in tabulations of the votes cast on proposals presented to stockholders. Thus, an abstention, direction to withhold authority, or broker non-vote with respect to a matter other than the election of directors, may have the same legal effect as a vote against the matter. With respect to the election of directors, an abstention, direction to withhold authority or broker non-vote will have no effect. An automated system administered by the Company’s transfer agent will be used to tabulate votes.

A stockholder entitled to vote for the election of directors can withhold authority to vote for eitherany of the nominees.

18

STOCKHOLDER PROPOSALS

The deadline for receipt of stockholder proposals for inclusion in the Company’s 20052008 proxy material is March 18, 2005.24, 2008. Any stockholder proposal should be submitted in writing to the Secretary of the Company at its principal executive offices. The stockholder proposal must include the stockholder’s name and address as it appears on the Company’s records and the number of shares of the Company’s common stock beneficially owned by such stockholder. In addition, (i) for proposals other than nominations for the election of directors, such notice must include a description of the business desired to be brought before the meeting, the reasons for presenting such business at the meeting, and any material interest of the stockholder in such business, and (ii) for proposals relating to stockholder nominations for the election of directors, such notice must also include, with respect to each person nominated, the information required by Regulation 14A under the Exchange Act. All other proposals to be presented at the meeting must be delivered to the Secretary of the Company, in writing, by June 3, 2005.

5, 2008.

FINANCIAL STATEMENTS

The Company has enclosed its Annual Report to Stockholders for the fiscal year ended April 30, 20042007 with this Proxy Statement. Stockholders are referred to the report for financial and other information about the Company, but such report is not incorporated in this Proxy Statement and is not a part of the proxy soliciting material.

OTHER MATTERS

Management of the Company knows of no other matters which are likely to be brought before the annual meeting. If any such matters are brought before the meeting, the persons named in the enclosed proxy will vote thereon according to their judgment.

| By Order of the Board of Directors |

| /s/ D. |

D. MICHAEL PARKER Secretary |

July 16, 200420, 2007

1619

APPENDIX A

CHARTER

OF THE AUDIT COMMITTEE

OF THE BOARD OF DIRECTORS

OF

KEWAUNEE SCIENTIFIC CORPORATION (the “Company”)

as amended June 22, 2004

| I. | Organization |

The Audit Committee of the Board of Directors shall be comprised of at least three directors who are independent of management and the Company. Members of the Audit Committee shall be considered independent if they have no relationship to the Company that may interfere with the exercise of their independence from management and the Company, and shall otherwise satisfy the applicable membership requirements under the rules of the Nasdaq Stock Market. No member shall have a relationship with the company that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Each Audit Committee member shall be financially literate, and at least one member shall be a “financial expert” as defined by the SEC.

| II. | Statement of Policy |

The primary function of the Audit Committee is oversight. The Audit Committee shall provide assistance to the Board of Directors in fulfilling the Board’s responsibility to the Company’s shareholders, potential shareholders, and investment community relating to corporate accounting, reporting practices of the Company, the quality and integrity of financial reports regarding the Company, and compliance with the Company’s Code of Ethics. In doing so, it is the responsibility of the Audit Committee to maintain free and open communication between the directors, the independent auditors, and the senior management of the Company.

| III. | Meetings |

The Audit Committee shall meet quarterly to review the financial results for the quarter before such results are released to the public and filed with the SEC, or more frequently as circumstances dictate. As part of its oversight function, the Audit Committee also shall meet at least annually with management and the independent auditors in separate executive sessions to discuss any matters that the Audit Committee or each of these groups believe should be discussed.

| IV. | Responsibilities and Duties |

The Audit Committee’s responsibilities include overseeing the accounting and financial reporting processes and financial statement audits. The Audit Committee believes its policies and procedures should remain flexible, to best react to changing conditions and to reasonably ensure to the directors and shareholders that the corporate accounting and reporting practices of the Company are in accordance with all requirements and are of the highest quality.

A-1

In carrying out these responsibilities and duties, the Audit Committee shall:

| A. | Audit Committee Charter/Report |

| 1. | Review and reassess the Audit Committee Charter as conditions dictate, but no less frequently than annually, and request the Board to revise the Charter, as necessary. |

| B. | Independent Auditor |

| 1. | Have sole authority to appoint, discharge and replace the independent auditor. |

| 2. | Review the performance of the independent auditor at least annually. |

| 3. | Establish a clear understanding with management and the independent auditor that the independent auditor is directly accountable to the Audit Committee. |

| 4. | Preapprove all audit and permissible non-auditing services to be provided by the independent auditor for the Company and its subsidiaries and the fees (or the range of projected fees) and other compensation for such services (subject to a de minimis exception under the law), review the independent auditor’s proposed audit scope, and disclose to investors in periodic reports filed with the SEC all reportable fees and other compensation paid to the independent auditor. |

| 5. | Review the independent auditor’s report on all relationships between the independent auditor and the Company to assess the auditor’s independence and consider whether there should be a regular rotation of the independent auditor to assure continuing auditor independence. |

| 6. | Discuss with management and the independent auditor the Company’s annual and quarterly financial statements and any reports, earnings press releases or other financial information submitted to a governmental body or the public. |

| 7. | Review the independent auditor’s reports describing (i) the Company’s critical accounting policies and practices to be used in the audit, (ii) the details of all alternative treatments of financial information within generally accepted accounting principles discussed with management, and (iii) all material written communications between the independent auditor and management. |

| 8. | Review annually a report by the independent auditor describing that firm’s internal quality-control procedures and any material issues raised by the most recent internal quality-control review, or peer review of the independent auditor, or by any inquiry or investigation by governmental or professional authorities and any steps taken to deal with any issues. |

A-2

| 9. | Consult and discuss with the independent auditor regarding internal controls, the fullness and accuracy of the Company’s financial statements and the matters required to be discussed by Statement of Auditing Standards No. 61. |

| 10. | Require that the independent auditor inform the Audit Committee of any fraud or illegal acts which it believes exist, or deficiencies in internal controls. |

| 11. | Following completion of the annual audit, review separately with each of management and the independent auditors any significant difficulties encountered during the course of |

A-2

the audit, including any restrictions on the scope of work or access to required information. |

| 12. | Review and resolve any significant disagreements between management and the independent auditor in connection with the preparation of the financial statements. |

| C. | Ethical and Legal Compliance |

| 1. | Review with the Company’s counsel, legal compliance matters including corporate securities trading policies. |

| 2. | Review with the Company’s counsel, any legal matter that could have a significant impact on the organization’s financial statements. |

| 3. | Review and approve all related-party transactions. |

| 4. | Review and assess periodically, and at least annually, the adequacy of the Code of Ethics approved by the Board, and recommend any modifications to the Code of Ethics to the Board for approval. |

| 5. | Direct members of the Company’s senior management to report any violations of, or non-compliance with, the Code of Ethics to the Committee. |

| 6. | If the need for independent counsel and other advisors is determined to be desirable in the performance of the Committee’s responsibilities, the Committee shall engage and determine funding for such counsel and advisors. |

| 7. | Establish procedures for the receipt and treatment of complaints regarding accounting, internal accounting controls or audit matters and for confidential submissions by associates of concerns regarding questionable accounting or auditing matters. |

While the Audit Committee has the responsibilities and duties set forth in this Charter, it is not the duty of the Audit Committee to plan or conduct audits or to determine that the Company’s financial statements are complete and accurate and are in accordance with generally accepted accounting principles. This is the responsibility of management and the independent auditor. Nor is it the duty of the Audit Committee to conduct investigations or to assure compliance with laws and regulations.

A-3

| This proxy when properly executed will be voted in the manner directed by the undersigned stockholder. If no direction is made, this proxy will be voted FOR the election of the nominees named in Item 1 below. Please mark your vote inside one box below. | Please Mark Here for Address Change or | ¨ | ||

Comments SEE REVERSE SIDE | ||||

1. Election of Class III Directors 01 Eli Manchester, Jr. 02 Margaret B. Pyle | FOR the nominees listed (except as marked to the contrary) ¨ | WITHHOLD AUTHORITY to vote for the nominee(s) listed ¨ | 2. In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the Meeting. | |||

If you wish to withhold authority for either of the nominees, write such nominee’s name in this space | ||||||